This post is something that is special to me, I thought of sharing my current portfolio as of today (6th of Sept) with you all!

Income:

Before starting, I just thought of clarifying one thing is about my income,

My primary income is from salary and There is “NO” secondary Income.

Debt:

I have around ( 10L ) debt, henceforth, to be safer, I decided to invest more conservatively.

Investment:

90% of my investments on my savings, Debt fund whereas 10% are in “Equity”.

Let me start with emergency and corpus fund, Generally, I have splitted into two. ( Debt fund & Savings Account ) according to my return expectations ( ~8% return ).

Debt Portfolio:

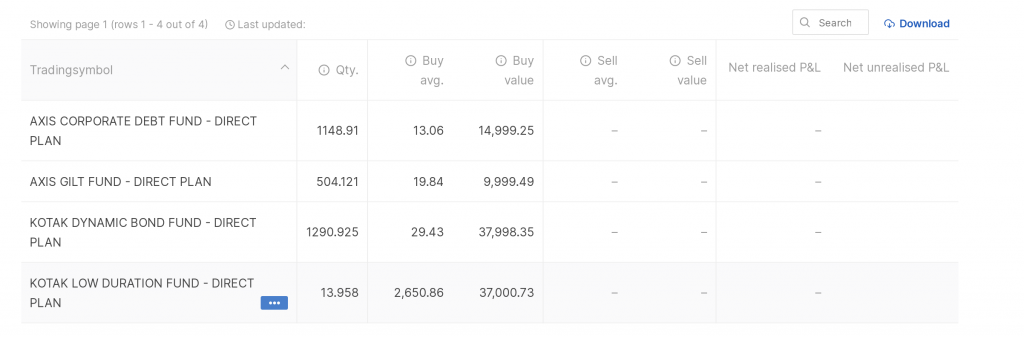

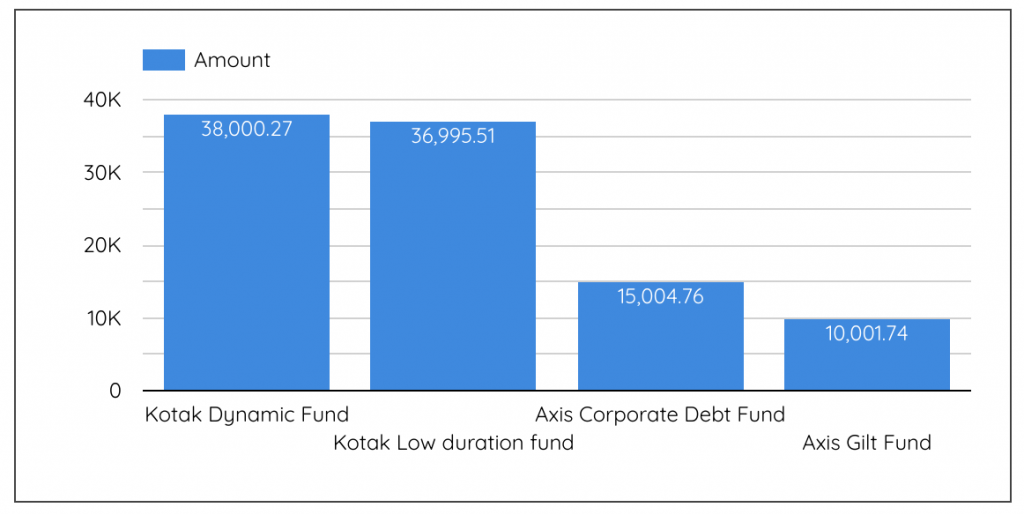

Part of my corpus ( 100k ) in Debt fund in the below scheme.

- I have invested around Rs.75k ( 75% ) in Kotak Dynamic fund and Low Duration fund.

- 15k into Axis Corporate Debt fund.

- 10k into Axis Gilt fund.

The primary reason behind picking Kotak Dynamic and Low duration fund is to minimize the risk.

- ~85% of Money has been invested in well-managed corporates including Govt. ( state and central ).

- ~15% of the money under well-growing companies.

- I bought a Gilt fund is for learning purposes.

The rest of the fund ( ~200k ) at which is parked in the IDFC First Bank Savings Account.

Even though, I’m a prime customer of HDFC Bank and holding the account for more than a decade. The interest and the benefit is not that great, ( around 3% of savings account holding and 4 to 5% for recurring/fixed deposits ).

My primary requirement is the interest rate, As per my analysis, RBL and IDFC First Bank’s are offering more or less the same benefits. I thought of using IDFC First Bank, which is 7% for the money which we are held on the account, 6.75% for the recurring deposit.

Beyond that,

The more interesting part is Equity

Equity Portfolio:

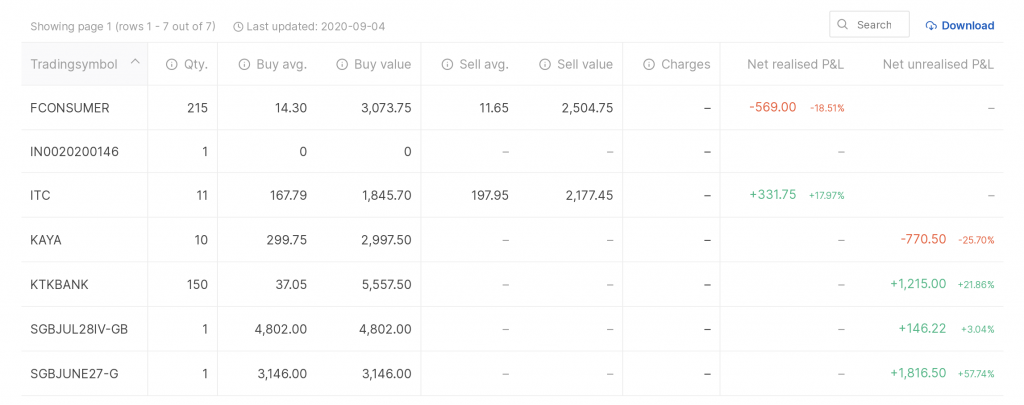

I have been holding KTK Bank, Kaya Ltd and sovereign gold bond for a while.

Recently, exited from ITC Ltd and Future Consumer due to my personal ethical and debt issue.

I have few stocks on my radar, waiting for a price correction to accumulate it. But again, I have been in the industry for the last 4 years and a lot more to learn, adapt, and grow.